Let's fund your business needs

Whether you need to fund moving into a bigger office, buy equipment or property or just to get the cash flow you need to act quickly,

we can make it happen. Apply now and get the cash you need within 24 hours.

CUSTOMER STORIES

Follow the funding success

Follow the Bread Box Bakery funding success

This is the inspiring story of The Bread Box Bakery, one of the first small start-up businesses to receive funding from VodaLend | Business Term Advance.

Vodacom

A small business success story

In December 2019, we decided to approach VodaLend, after a partner had heard about its products in a radio interview. What an inspired decision this was!

Aiden Sookdin

WATCH HOW EASY IT IS

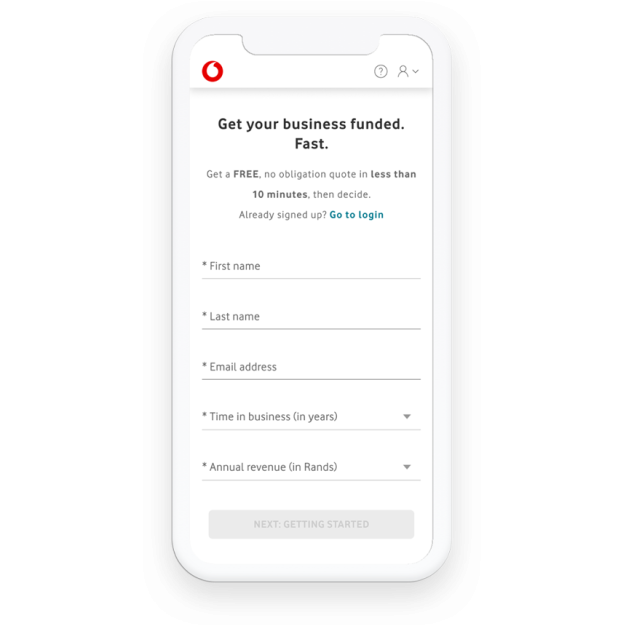

Take four simple steps to apply

Apply for finance from any smart device, from anywhere in the world.

Witness the effortless end to end digital application experience.

I got R100 000 to help cover gaps in my cash flow while waiting for my customers to pay me back. I chose a 12 month repayment plan and only repaid R124 000.

Term & Rates are unique to each individual customer application

FAQs

Everything you need to know…

Our minimum requirements for funding are much less intensive than those of banks. All you need is for your business to be located in South Africa, make an annual revenue of R500 000+ and be in business for at least 1 year.

You need to provide your business's company registration number or VAT number if you're operating as a Sole Proprietorship as well as your companies financial history. Your best chance of success is to link your company bank account through Yodlee or your accounting package through Xero or Sage One Accounting. At minimum you need to provide pdf copies of your last 3 months bank statements.

You can use the funding for anything your business needs. This can be for bridging receivables gaps, managing cash flow, buying inventory and equipment, hiring employees, etc. Anything your business needs.

We give you access to the best legal advisors for your business legal needs - including telephonic legal advice on aspects relating to contracts, labour disputes, debtors, applicable legislation and regulations, licensing and litigation. Get it for FREE for the entire duration of your funding period.

Need to get in touch with us? Simply call us on 082 1960 and press option 6 or email [email protected] and our Customer Care agents will assist you.